Thursday, June 28, 2012

DDA meeting of 6.21.12

May be viewed by the public on channel 18 on Tuesdays and Saturdays at 9 am and 7 pm. The followed article in the Sun Times reports that meeting.

Thursday, June 21, 2012

Janet Kreger's Comments at DDA meeting 6.21.12

Hello.

I’m Janet Kreger with the Michigan Historic Preservation Network.

I am here to again speak with you about the Longworth Property.

The

Longworth Property has been a feature on the Chelsea streetscape for

more than a century. During that time, the three buildings have seen

their heyday, but also a more recent period of decline.

Until

earlier this week, these buildings were slated to become a lively new

center of dining, retail activity, and downtown living. We thought

these buildings were safe when a qualified development team stepped

forward to invest in them. But that team has backed away.

These

past few years have been tough for old buildings. The Michigan

Historic Preservation Network knows this because it works all over

the state with DDAs, City Councils, preservation groups, and

individuals who are re-using economically viable historic buildings.

In

many communities, projects have not gone forward because there simply

have been no investment dollars out there. But the development team

of Abe Kadushin, J.C. Beal, and their partners seemed to reflect a

sea change. They wanted to invest in Chelsea because they knew the

potential of the Longworth site.

What

stood in the way was nothing more than the need for additional time

because the DDA’s June 7 Resolution raised concerns for the

development group.

First,

the Resolution specifically stated, “that the DDA invites the

development team to submit its draft agreement to the DDA on or

before June 21, 2012…(and it) must

be accompanied by the irrevocable bank letter of credit of $1M or

other security acceptable to the DDA…” This was a two week

timeframe.

Second,

the Resolution specifically stated, “Due diligence and other

contingencies, including financial commitment, shall end

September 7, 2012, when the agreement shall become firm...” This

was a 90-day timeframe.

Both

timeframes were too short to pull together the financial packaging

for an adaptive reuse project of this size and scope.

Here’s

why. In addition to other financing, the developers needed to

qualify the Longworth project for two incentives reserved for

historic buildings. The first incentive’s application has a 60-day

review process. It must be approved before the second can even be

prepared and begin its own 30-day-plus review process. Only when

these incentives, other financing, and due diligence come together,

could a letter of credit or other security be secured. If you were

counting with me here, 90-days had been exceeded.

This

is a seasoned team of professionals with a track record of working

with challenging preservation projects. Their proposal was for an

approximately $3.7 million redevelopment including private equity,

incentive financing, and debt financing in addition to the equity

investment of one of the project partners who wished to live in

Chelsea in the Longworth Property. What they sought from Chelsea was

flexibility on timeframes based on the realities of their challenges.

The

City of Chelsea had the opportunity both to save historic buildings

important to the community and to fulfill its fiscal responsibility

to its residents. Some flexibility was needed. The development team

might still be available to talk. Will you, as members of the DDA,

talk with them?

Jan Bernath's Comments 6.21.12

My

name is Jan Bernath, and I am on the Preservation Chelsea Board of

Directors.

Janet

Kreger of the Michigan Historic Preservation Network has just spoken

about the time constraints that were determined by the Kadushin/Beal

Team and their legal counsel to be too tight to complete what needed

to be done. Additionally, however, I

believe we also arrived at the point of the withdrawal of the

Kadushin/Beal proposal due to misunderstanding. Specifically,

the resolution passed by the DDA at the meeting on June 7, 2012

placed new requirements on the developers beyond the goals and

requirements of the request for proposals issued by the DDA and to

which Kadushin/Beal responded. One key misunderstanding stemmed

from how the developers were to demonstrate their financial ability

to do the project.

Goal

2 of the RFP stated that the “offer to purchase must be accompanied

by a firm commitment from a financial institution or equivalent

source

for a minimum of $1 million for investment in the property and

improvements.” Accordingly, the Kadushin/Beal development team

presented a financial package of $3.7 million in their proposal to

redevelop the Longworth Property. They presented their sources

for their redevelopment dollars including private equity, incentive

financing, debt financing, and the equity investment of one of the

project partners who intended to take up residency in the building.

They presented these ‘equivalent sources’ – equaling well more

than the $1 million minimum - knowing that a firm commitment from a

financial institution would not be possible this early in their

project.

However,

the resolution of June 7 stated that “the agreement must be

accompanied by the irrevocable bank letter of credit of $1 M or other

security acceptable to the DDA to secure improvements in the property

and to cover any cost or damages incurred by the DDA and the City for

site restoration or removal of incomplete improvements if the project

fails, after satisfaction of due diligence contingencies.”

Just as the “firm commitment from a financial institution”

requested in the RFP was not possible, it was even less possible to

secure an “irrevocable bank letter of credit of $1 M” in this

short timeframe. Unable to ask questions of Chelsea leadership

about what further they could add about “equivalent sources,” the

Kadushin/Beal attorney told them to back away from the project.

As

you can imagine this resolution caused misunderstanding between the

DDA and the developers. Sadly, the Kadushin/Beal team withdrew their

proposal based on this misunderstanding.

John Frank's comments at DDA meeting 6.21.12

John Frank’s comments to DDA

21JUN2012

I’m

John Frank, President, Preservation Chelsea.

It

can be said that perception is reality. Your resolution of June 7

has been perceived to have imposed a higher level of financial

performance than the RFP had specified. It could be perceived to

have erected insurmountable barriers – show stoppers – in the

path of this project.

A

$3.7 million investment in Chelsea is within our grasp. Surely

nobody here wants this to slip away due to misperceptions.

The

Kadushin Associates team has an excellent track record of

accomplishment. If Chelsea loses this, their 3.7 million dollars

will wind up in another community.

Please

initiate

a meeting with the Kadushin/Beal principals to resolve the

misunderstandings.

Thank

you.

Wednesday, June 20, 2012

draft minutes from 6.7.12 meeting

CITY OF CHELSEA

DOWNTOWN DEVELOPMENT

AUTHORITY

BOARD OF DIRECTORS

SPECIAL MEETING

7:30 A.M., THURSDAY,

JUNE 7, 2012

DRAFT

| Present: | Flintoft, Cleary, Finger, Heydlauff, Holman, Lindauer, Merkel, Morrel-Samuels, Pierce, Povlich, Sanville, Schwarz |

| Absent: | |

| Others Present: | City Manager Hanifan, Library Director Harmer ; Albertson, Anderson, Feeney of City Council; Cathy Bean, Jan Bernath, John Frank of Preservation Chelsea;Janet Kreger, Katherine Reisig of MHPN; Joe Jeffreys of First Congregational Church; Nicole Pangas Henry, CCA; Residents: Kathy Carter, Hank Muir, Nancy Whitelaw, Nancy Anderson, Peter Heydlauff, Jane Creswell, Scott McElrath; Lucy Silverio of Sun Times, Lisa Allmenger of AA.com; Ron Gordon of FCC; Tom Girard - Chelsea Connection; Cathy Clark, Cary Church, Rob McFate |

President

Flintoft opened the meeting at 7:30 a.m.

- Flintoft opened the floor for Public Participation:

-John Frank noted that either project would support and preserve landmarks, financially benefit the city, spur economic growth, improve the tax base, improve property values. He is available to assist with historic knowledge

-Cathy Carter spoke of a 400 yr. old community whose city center changed and evolved. The developers who responded to the RFP see value in the property and the proposals are opportunities even if not perfect.

Janet Kreger hopes that the DDA can work with the developers because securing grants and tax credits can be time consuming. If abatements granted, can be rolled back.

-Kathy Bean encourages transformation and making a choice. Larry Bean is a member of the Depot Association Board of Directors, which controls the parking on both sides of the depot. The Board would like to meet with the DDA in that regard. - Flintoft asked that each Board member comment on the two RFPs, stating their preference.

-Pollack's plan was the choice of several members. Povlich, Pierce, Lindauer originally rejected both because of concerns regarding financing. Flintoft observed that they did not meet their financial commitment. There must be a financial commitment to cover the unlikely event that the project begins but is abandoned and the DDA must restore the property.

-The tax abatement issue concerned the board because DDA has no control over that and the point of development was to return the property to the tax rolls. IFTs are for existing industrial properties which enhances what the city already has. The taxes generated by a new development is necessary to support the the project. - President Flintoft presented Draft Resolution #6 which the Board reviewed. The Board had a general discussion regarding what would happen if the project was in process and failed. Once they have a final mortgage on the property, the DDA has no claim on it.

- Motion by Flintoft, second by Morrel-Samuels to approve Resolution #6.DISCUSSION: Holman was concerned that there be a specific financial commitment by a bank, after due diligence, and by a specific date. The original request by the developer was for 6 months. Heydlauff pointed out that there needs to be progression in the project and wants a commitment in 90 days. The DDA needs to protect its investment.Motion by Sanville, second by Lindauer to amend Resolution #6 to include amount of $1M bank letter of credit, no tax abatement and allowing for due diligence on part of developers. Motion carried. Followed by vote on original motion . Motion carried.

Chelsea

Downtown Development Authority

Jackson

Street Corridor/Longworth Resolution #6 (as amended)

At

a regular meeting of the Chelsea Downtown Development Authority of

the City of Chelsea, County of Washtenaw, State of

Michigan(hereinafter referred to as “DDA”), held on June 7, 2012

The

following resolution was offered by Member Flintoft and supported by

Member Morrel-Samuels and after discussion and upon roll call vote

was duly adopted:

Whereas,

the DDA's Request for Proposals (RFP) has solicited two proposals,

one by Kadushin/Beal development team and another by the

Prochaska/Zachary development team. Neither proposal has demonstrated

the financial commitment as requested. Each proposal requests tax

abatements from the City which are beyond the authority of the DDA to

accept or obtain. The mixed use of the Kadushin/Beal proposal is the

most viable.

Be It Resolved, that the DDA invites the Kadushin/Beal team to submit its draft agreement to the DDA on or before June 21, 2012, for acquisition and development of the Longworth property on the conditions and requirements of the RFP with the following modifications:

Be It Resolved, that the DDA invites the Kadushin/Beal team to submit its draft agreement to the DDA on or before June 21, 2012, for acquisition and development of the Longworth property on the conditions and requirements of the RFP with the following modifications:

1. The

agreement must be accompanied by the irrevocable bank letter of

credit of $1M or other security acceptable to the DDA to secure

improvements in the property and to cover any cost or damages

incurred by the DDA and the City for site restoration or removal of

incomplete improvements if the project fails, after satisfaction of

due diligence, contingencies.

2. No tax abatements in the agreement.

2. No tax abatements in the agreement.

3. Due

diligence and other contingencies, including financial commitments,

shall end September 7, 2012.

4. Any

conveyance prior to final mortgage financing shall be subject to a

right of reverter on the condition that the project is completed and

on breach of the condition title shall revert to DDA.

5.

Developer can have immediate access upon the execution of agreement

for due diligence activities.

- Public Participation: Pastor Joe Jeffreys of First Congregation Church noted that his office overlooks the proposed project space andwill be happy to get involved.

Jan Bernath expressed concern that 90 days was too short of a time. - President Flintoft declared the meeting adjourned at 8:15

Notes:

In the Board discussions, there was several times when members echoed

agreements without additional comments. To avoid redundancy, those

were not included.

Chelsea

citizen Harry Zoccoli emailed a letter to the DDA Board, read by the

members, in support of the Longworth project. He sited the official

DDA Mission Statement as reference for moving forward.

Tuesday, June 19, 2012

Developers withdraw proposal for redevelopmenet of Longworth Properties

because of the DDA resolution. See side bar for resolution.

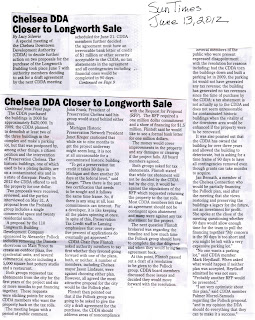

Wednesday, June 13, 2012

Thursday, June 7, 2012

Tuesday, June 5, 2012

Make history to preserve history THIS THURSDAY at the DDA meeting

If you are able, show your support for keeping our historic buildings. Your presence counts at the DDA meeting this Thursday, June 7, at 7:30 am in the McKune Room.

Subscribe to:

Comments (Atom)